In 2021, the global retail market of disposable hygiene products is 112 billion US dollars and is expected to reach 129 billion US dollars by 2026, of which the Asia-Pacific region contributes more than 40% of global retail sales. Mainly driven by factors such as increasing hygiene standards, growing consumer awareness, increasing purchasing power, and constantly innovating and improving products.

In the Asia-Pacific region, China and Southeast Asia together account for more than 70% of sales, with China accounting for the largest share. In 2021, the retail sales of disposable hygiene products in China will be US$28 billion, and that in Southeast Asia will be US$6 billion. Indonesia and Vietnam are the engines of economic growth in the region.

Declining regional birth rates challenge long-term growth prospects for baby diapers

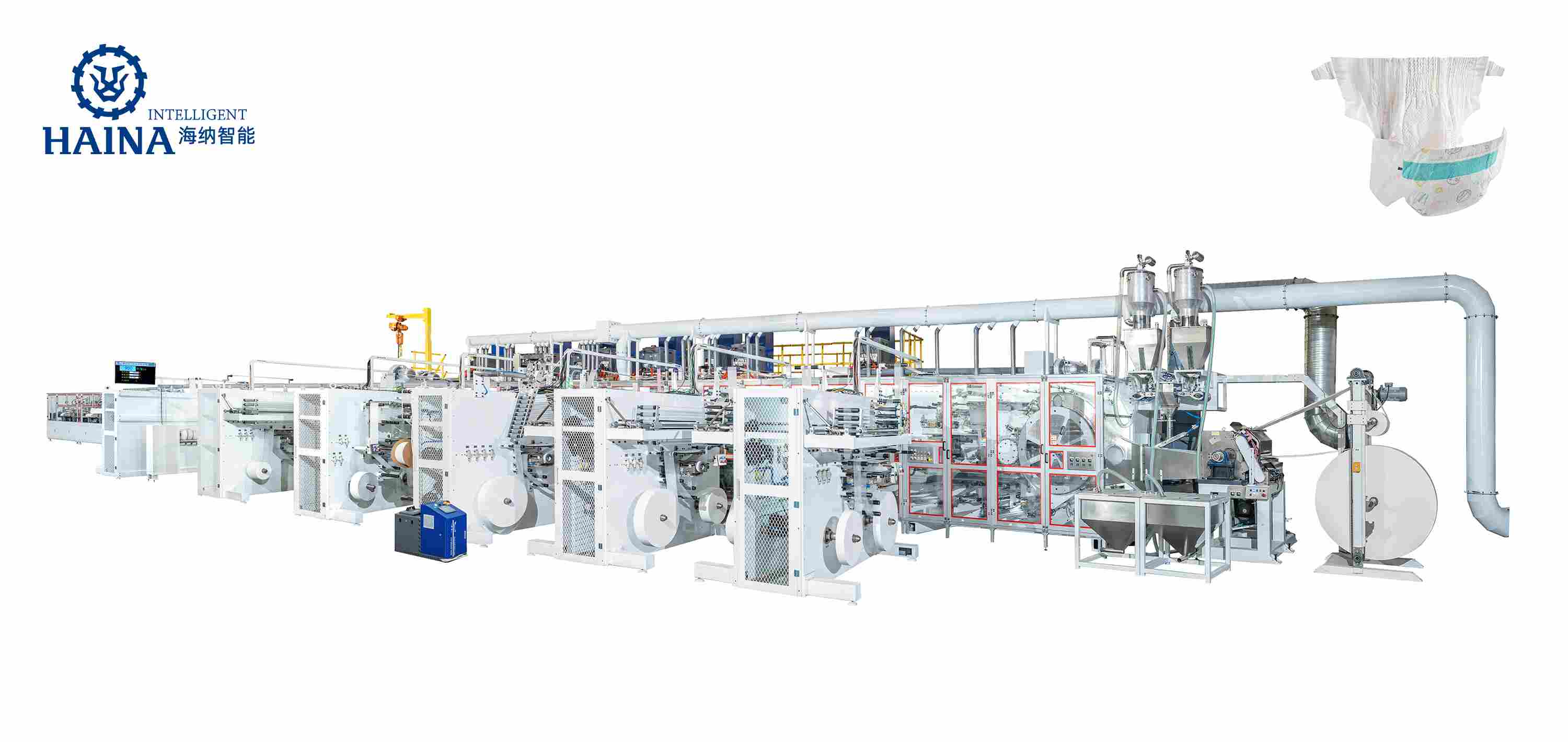

Baby diapers are one of the largest contributors to the retail sales of disposable hygiene products in the Asia-Pacific region. However, growth in this category has been limited by declining birth rates across the region. The most populous country in Southeast Asia, Indonesia's birth rate has dropped from 18 per thousand five years ago to 17 per thousand in 2021. China's birth rate has dropped from 13 per thousand five years ago to 8 per thousand, which means the number of children aged 0-4 has dropped by more than 11 million. It is estimated that by 2026, the population using diapers in China is estimated to be about two-thirds of what it was in 2016.

Family planning policies, changes in society's attitudes towards family and marriage, rising education levels, and rising female labor force participation are key factors contributing to the decline in birth rates in the region. In May 2021, China announced a three-child policy to reverse the trend of an aging population. It is unclear whether the new policy will have a significant impact on the population, but China's two-child policy, introduced in early 2016, has failed to sustain a surge in births.

Despite the shrinking consumption base, the retail sales of baby diapers in the region are expected to show positive growth over the next five years. Per capita consumption levels in the region are still low compared to developed countries, so there is room for growth. Despite the higher price, the pant type shows a healthy demand due to convenience and durability. Pants are increasingly preferred by parents because they help train children to use the toilet and develop their sense of independence. Manufacturers are also developing new products, for example, in Indonesia, leading producer Softex (now owned by Kimberly Clark) launched the new Sweety Gold Pants NextGen in 2021, which is designed to promote freedom of movement for babies.

As per capita consumption in the region remains low and there is a large untapped consumer base, the industry has the opportunity to further drive market penetration through retail expansion, product innovation and attractive pricing strategies. However, while innovation in the premium segment through more sophisticated value-added products and ancillary models contributes to value growth in this segment, sound pricing strategies remain critical for wider product adoption.

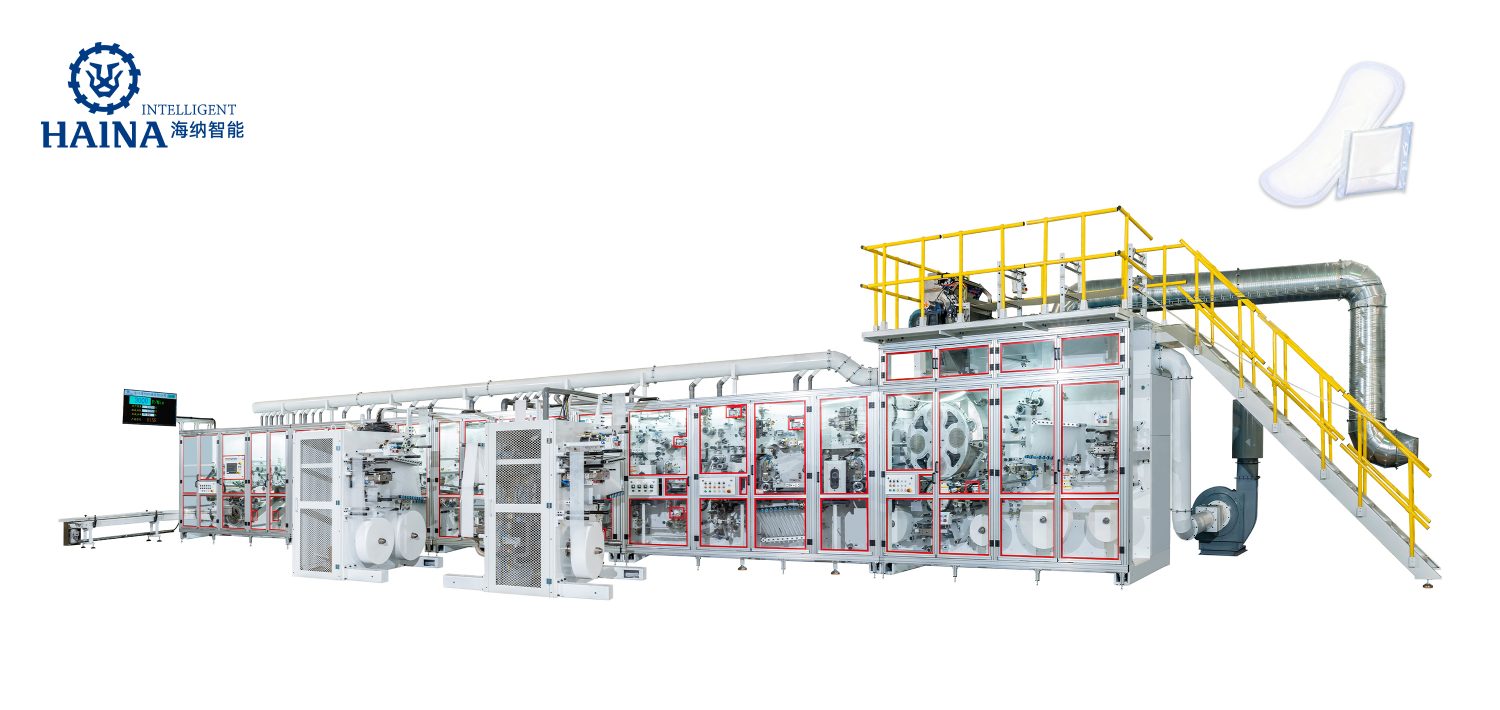

Innovation and education key to advancing women's nursing

In terms of value and volume, feminine hygiene protective equipment is the largest contributor to retail sales of disposable hygiene products in the Asia-Pacific region. In Southeast Asia, the female population aged 12-54 is expected to reach 189 million by 2026, and the feminine care category is expected to grow at a CAGR of 5% between 2022 and 2026 to reach US$1.9 billion. On the other hand, in China, feminine care faces a number of challenges, including already high per capita towel (sanitary napkin) consumption and an aging population. Subsequently, the category is expected to see only modest growth, mainly driven by upward trading and premiumization.

Increasing women's disposable income and continued education efforts by governments and nonprofits to address women's health and hygiene are helping drive growth in retail and industry innovation.

Innovation work in this category revolves around product functionality and value-added features. For example, in Indonesia, leading manufacturer Softex has launched a range of value-added products over the past few years, including Softex Celana Memenasi - sanitary napkins in the form of pants. The success of this model has prompted other major manufacturers to launch similar products, such as Unicharm's Charm Sleep Protect Panties. In China, market leader Sofy has launched a new hybrid product in 2020 that uses patented Japanese technology to add warmth to the sanitary napkin that extends to the lower abdomen for added comfort. However, this innovation comes with a high price tag that could limit growth prospects for high-income consumer groups.

Over the years, the Asia-Pacific region has also become increasingly concerned about waste from feminine hygiene products and the need for more sustainable alternatives. According to Euromonitor International's 2021 Global Consumer Health and Nutrition Survey, 21% of respondents in China, Indonesia and Thailand use reusable underwear and 8% use reusable sanitary pads. While price may be a consideration in switching to reusable products, more consumers are also looking for environmentally sustainable options. In Vietnam, local Vietnamese brand Green Lady Vietnam offers reusable hygiene products to environmentally conscious young consumers. In addition, Chinese lingerie brands NEIWAI and Uniqlo have launched washable underwear as an alternative to disposable products. While retail sales of these products are still small, sales of reusable alternatives have been growing compared to single-use products. This trend presents both challenges and opportunities for disposable feminine care brands to address sustainability issues through innovative products and packaging to appeal to an eco-friendly consumer base.

While innovation in function, material, form and value-added benefits will remain one of the drivers of economic growth in Southeast Asia and China, brands need to find a balance between quality and price in order to attract more Multi-user, and low-income consumer groups are the main component of the untapped consumer group.

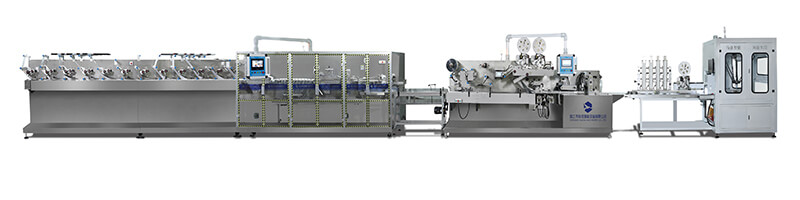

Preventive hygiene measures remain on the agenda and support demand for wipes

Wipes benefited the most from the 2020 pandemic, but growth slowed in 2021 as demand normalized. However, on a per capita basis, wipes use is still higher than pre-pandemic levels. In terms of value, Southeast Asia and China are expected to continue growing healthily, with a CAGR of 11% and 8%, respectively, from 2021-2026. Rising incomes, increased awareness of wipes, innovation and the rise of e-commerce are also positive drivers of demand and sales.

When it comes to new product development, while antimicrobial properties remain a welcome feature and innovation focus, other products include natural, hypoallergenic, water-based, skincare and biodegradable. Recyclable packaging has also become more visible as the industry seeks to meet sustainability goals.

Huge unmet potential expands opportunities in Southeast Asia and China

Over the next five years, China and Southeast Asia are expected to experience positive growth in retail sales of disposable hygiene products, accounting for nearly 85% of absolute growth in Asia Pacific. While changing demographics may pose increasing challenges to the organic growth of baby diapers, increased consumer awareness, affordability, persistence of habits and product innovation in disposable hygiene products will help to drive performance in the single-use hygiene category, especially given that there is still a lot of unmet potential in the region. However, it is also necessary to acknowledge the economic and cultural differences of each market in Southeast Asia and China in order to successfully meet the needs of local consumers.